In this December 2022 issue, you will find the following articles:

- Andy Sexe, Valley Agencies

- Dan Patrick, Guinn, Vinopal & Zahradka, LLP

- Tim Jaynes, ISC Financial Advisors

Home System Protection (HSP)

Many people assume that their in-home appliances, washers, dryers, stoves and refrigerators, freezers, heating and cooling systems are covered by their homeowner’s insurance for breakdowns, the realty is most often not. When these home systems break down, the cost to repair or replace can run well into the thousands.

There is a way for these home systems to be covered however, by adding an endorsement to your homeowner’s policy, called Home System Protection (HSP).

HSP is not new and is widely available through both large national carriers and smaller regional carriers. This affordable endorsement pays for repair or replacement of a wide range of appliances and equipment that may not be covered by a standard home policy.

The cost of the endorsement can range from $20 to $100 annually.

What HSP Covers:

The HSP endorsement protects your in home systems and equipment from mechanical breakdown and sudden and accidental loss. Typically, it covers anything that cannot be unplugged or moved, such as central air conditioning and heating systems, along with larger appliances that can be unplugged but not moved, such as refrigerators, freezers, etc. No, it will not cover your coffee maker, blender, or toaster. Nor does it provide coverage for losses due to normal wear and tear.

Example of a covered loss:

An insured discovered that the oven would not turn on, after a repair person looked at, it was discovered that it had experienced a control device failure which burned out all the heating elements. The stove had to be replaced and was covered under the HSP endorsement.

Employee Retention Tax Credit

Most business owners have heard of the Employee Retention Tax Credit (ERTC) via friends, colleagues or industry professionals but may not know whether they are eligible. Unfortunately, there are a lot of misconceptions and confusion surrounding the ERTC. It can be quite complex to determine if a business qualifies and if so, how much is the business eligible for. Outlined below is a brief history and summary of the ERTC to get business owners thinking about potential tax saving opportunities.

History

The Employee Retention Tax Credit (ERTC) was enacted under the March 2020 CARES Act to encourage businesses to keep employees on their payroll. Originally businesses had the option to take advantage of either the Paycheck Protection Program (PPP) or the ERTC as a means of financial relief and to keep employees on payroll.

Then in December of 2020 Congress passed the Relief Act which amended and extended the ERTC. The extension furthered employers to continue claiming the ERTC for quarters 1 & 2 of 2021. This was great news for those businesses already claiming the ERTC. By amending the CARES Act the Relief Act also changed who could qualify for the ERTC. The Relief Act changed the laws so employers could then claim both the PPP and ERTC. This meant that businesses could retroactively claim the ERTC for tax year 2020 even if the business had already claimed the PPP. This also meant that businesses could claim both the ERTC and PPP going forward into 2021.

The American Rescue Plan (ARP Act) enacted by Congress in March of 2021 extended the ERTC through Quarters 3 & 4 of 2021 entitling businesses to claim the ERTC for the entire year. Unfortunately, in November of 2021 the Infrastructure Act enacted by Congress rescinded the 4th Quarter of 2021 as an eligible ERTC quarter for those business that are not considered a Recovery Startup Business (explained later).

How does my business qualify?

In general, there are two ways to qualify for the ERTC. There is also a third option that is less common for a business to qualify under. Below are the three ways to qualify. Passing any of the three tests qualifies the business for the ERTC so long as the business paid qualifying wages to its employees.

- A business must be subject to a government ordered shutdown. If a business was ordered to wholly or partially shutdown due to a government order the business would be eligible for the ERTC for that shutdown period.

- A business must experience a decline in gross receipts when comparing sales by quarter to the same quarter in 2019. 2019 was used since that was the last tax year before COVID-19 hit. For 2020, the decline in gross receipts must be 50% compared to the same quarter in 2019. For 2021, the decline in gross receipts must be 20% compared to the same quarter in 2019.

- Lastly a business may qualify as a Recovery Startup Business (RSB). A RSB is an employer who began carrying on any trade or business after February 15, 2020, for which average annual gross receipts of the employer do not exceed $1,000,000.

How much do I get if I qualify?

The ERTC covers both 2020 & 2021. However, the credit amounts and calculations are different for each year. Below is a summary of each tax year.

- For 2020, the credit is equal to 50% of qualified wages per employee from March 12th – December 31, 2020, maxed at $10,000 per employee. Therefore, the credit is a maximum $5,000 per employee for 2020.

- For 2021, the credit is equal to 70% of qualified wages per employee per quarter maxed at $10,000 per employee per quarter. Therefore, the credit is a maximum $7,000 per employee per quarter or $21,000 per employee for 2021.

How do I claim the ERTC?

After a business determines they qualify and calculates their total credits by each quarter the business claims the ERTC by filling amended quarterly payroll tax returns for each quarter it qualified.

Tax Consequences

Unlike the PPP the ERTC does not qualify for forgiveness. The IRS requires that any ERTC claimed must reduce wage expense on your tax return based on the year the ERTC was claimed. That would mean if you have not already claimed the ERTC you will be required to amend your tax return and pay any additional tax as part of claiming the credit. As an example, a C Corp business qualified for a $10,000 credit. C Corp tax rates are currently 21%. Therefore, the business would owe $2,100 in taxes after the business received its $10,000 credit.

Every state is different on whether they tax the ERTC. A business owner will need to determine with their tax professional if their business is subject to state income tax when claiming the ERTC.

Final Thoughts

Determining if your business qualifies can be quite complex and you may have also heard you don’t qualify with outdated information. The laws have changed quite a lot since inception of the ERTC. IRS guidance clarified many of the issues outlined by tax professionals. This guidance didn’t come until months after the laws were passed by Congress. A business has 3 years to claim the ERTC so there is plenty of time left to determine if you qualify and get your refunds.

GVZ is happy to consult with you and your business to put together a tax strategy. You can contact Dan Patrick at daniel@gvzllp.com or 715-386-1212.

Five Strategies to Consider Before Year-End

The 2022 market has been challenging. The good news is, there are strategies that can help you take advantage of a lower market and high volatility. Timing is important, though. So, before it’s too late, ask yourself if any silver linings might be available to you and your family before the clock strikes midnight on New Year’s Eve. Here are several that might help you save on taxes this year.

1. Buy low.

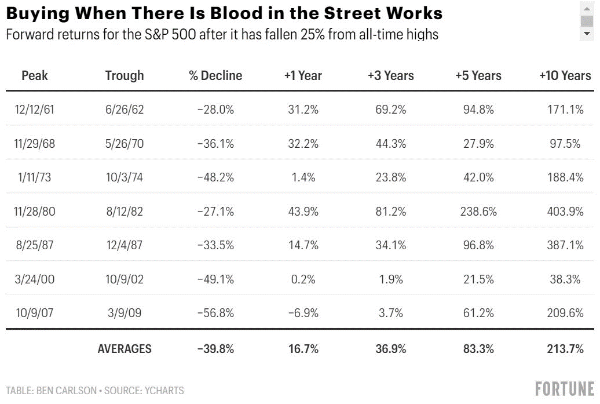

Sounds easy, right? It's hard to do in practice, even for the pros. Consider putting extra cash to work in investments with high appreciation potential, or even ones with an improved yield. We aren’t talking about market timing here, but if you have cash above what you need for emergencies, then dipping your toe into stocks and low-cost funds today should prove to be a wise move when looking out a few years

or more. According to history, on average, stocks rally nearly 40% in the three years after a major decline (like the one we have seen this year.)

or more. According to history, on average, stocks rally nearly 40% in the three years after a major decline (like the one we have seen this year.)

Big Returns Come After Steep Losses

2. Fully fund your tax-advantaged accounts.

We’ve made the case that investing after a big downturn is often an advantage in the long run, but in which accounts should the money go? We suggest those offering tax advantages. Roth IRAs, Traditional IRAs, Health Savings Accounts, and other retirement plans are great choices.

You might even consider accelerating or pulling forward retirement contributions. You can do that by making 2023 contributions at the very start of next year. Before you front-load investments into your

401(k), though, be sure to check with your employer to ensure they have a “true up” on the match so you do not miss out on any company contributions.

401(k), though, be sure to check with your employer to ensure they have a “true up” on the match so you do not miss out on any company contributions.

Also, consider completing any regular or backdoor Roth IRA contributions now. Roth conversions during a down market may also be especially advantageous. Finally, be sure to set a reminder on your calendar to make 2023 Roth contributions, too.

3. Share.

A wealthy philanthropist once told us that giving diligently can feel almost harder than making money to begin with. Taxes matter: where you give from plays a role, when and how much to give is critical, and simply analyzing all the possible tax scenarios is important so you and your family make the most of the donation. There are several techniques for giving effectively and efficiently, including direct gifts of highly appreciated shares, using donor-advised funds, and, if you are 70 ½ or over, “qualified charitable distributions” from your retirement accounts.

4. Get a bit familiar with the tax code and calendar.

Tax rates are scheduled to rise in 2026. While we don’t know exactly what those brackets will be, it could make sense to take steps to accelerate income, so you pay today’s likely lower rates. We get it – many of us are told to NEVER pay taxes we can avoid. In this case, however, if you can pay them early at a lower rate, in many cases the positive impact can be hundreds of thousands of dollars, sometimes millions.

5. Review gains and losses.

Tax loss harvesting is one of the hidden benefits of an underperforming stock and bond market. Some techniques allow us to “harvest,” or realize, losses to offset current and future capital gains, and sometimes ordinary income as well.

The Bottom Line

Market declines are part of the investing landscape. Don’t let them get you down. Instead, consider optimizing the opportunities they can present. We can work with you to see what makes the most sense for your financial situation and long-term plan.

Thanks for looking, and if you are interested in discussing some final 2022 moves, please reach out sooner rather than later. Things can get very busy at year end.