In this December 2020 issue, you will find the following articles:

- Tim Jaynes, ISC Financial Advisors

- Cameron Kelly, Lommen Abdo

- Brian Hinz, Studio EA

DO YOU LIKE SAVING MONEY?

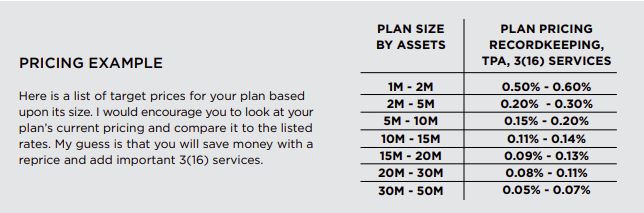

If you want to learn how you could save your company thousands of dollars annually on 401k fees, this is a must-read. The pace of change in the 401k industry has been accelerating recently, and this can benefit you and your business. Today, the 'race to get big' in the 401k space has presented plan sponsors with an opportunity to hire top tier service providers at rock bottom pricing. Both recordkeepers and Third-Party Administrators are quickly increasing their scale and new services to keep their deliverables relevant.

Recordkeepers

As a result of these changes, recordkeeper consolidation is now happening faster than at any time in the past. Some notable transactions include:

- Transamerica acquired Diversified Investment Advisors and Mercer

- John Hancock acquired New York Life

- Empower acquisitions: Great West, Putnam, JP Morgan, Wells Fargo, Mass Mutual (Mass Mutual purchased Hartford a few years back.)

- Numerous other acquisitions have occurred in the past few years.

Today recordkeepers need to grow aggressively, or they risk not keeping up with their competitors. This dynamic means that they need to add as many participants to their system as possible in the shortest time possible. To grow their customer base, many providers have chosen to offer their services at very low prices, practically giving them away!

If you have not had your plan repriced by your current recordkeeper or put your plan out to bid recently, I suggest you do so.

This past week I ran across two plans with above market pricing and a service structure that was years out of date. With ISC's help, we were able to significantly decrease their expenses and add more service and plan support.

The first was a $2 million plan that charged its participants over 1% annually for administration. To make matters worse, the investments were also very expensive. The average overall expenses for a typical participant with a balanced portfolio was about 1.82%.

- The current market rate for a plan of this size, plan administration, and investments in a balanced portfolio is about 0.77% all-in.

- This is a savings of 1.05% compared to the current plan price, or 42%.

- For a participant with a $500,000 account, the lower price would save them over $5,000 per year in expenses.

- Repricing this plan will save the plan's participants over $20,000 annually with the added benefit of better plan administration services.

The second plan was a $20 million plan with an annual expense of 0.21% paid by its participants for plan administration, with the average total expense of about .49% for a balanced investment portfolio.

- The current market rate for this plan—plan administration and balanced portfolio expense—is about 0.31%

- Repricing this plan will save the participants approximately $36,000 annually and increase the services to the plan.

Third-Party Administrators:

TPAs, and some recordkeepers, have added 3(16) administrative fiduciary services to their traditional offerings.

This service allows you, the business owner/plan sponsor, to offload most of your daily administrative duties in running your plan to the 3(16) providers without sacrificing fiduciary coverage.

Below are some highlights of the work you can offload by adopting 3(16) services.

- Annual notices

- Payroll contributions submission

- Prepare and sign 5500s

- Prepare and deliver SAR's reporting

- Handle annual audit for large plans

- Monitor eligibility

- Send enrollment kits to newly eligible employees

- Review payroll data every pay period to ensure accuracy

- Administer all loans, withdrawals, and rollovers

This new service has proven to be both a time and money saver for our clients while enhancing your plan's fiduciary coverages.

Within the past couple of weeks, you should have received your 'fee disclosure' from your provider. I would encourage you to compare your current services and pricing on your 401(k) against the quotes listed in this article.

If you would like to discuss your 401(k), service, or pricing options, please give me a call at 612-710-0654.

Thanks for taking a look, and I hope you find this information helpful.

____________________________________

THE FEDERAL ESTATE TAX: WHAT TO EXPECT WITH A BIDEN PRESIDENCY

A frequent concern for estate planning clients is how to avoid owing estate taxes at their death. Because the estate tax has become a political issue, some of these clients are also concerned about how the election results might impact the estate tax. The following is a basic explanation of the federal estate tax and some thoughts on what to expect over the next few years.

What is the Federal Estate Tax

The estate tax is a tax on the value of a person’s estate at the date of their death. If you add up the value of all your property (house, cars, personal property, bank accounts, life insurance, investments, retirement, etc.) you will have the approximate value of your estate. Next, add in significant gifts (currently greater than $15,000 per recipient per year) that you have made during your lifetime. If the total exceeds a threshold referred to as the “federal estate tax exemption,” you have a taxable estate and your estate may owe tax after your death.

The federal estate tax has changed significantly over the last 23 years. During that time, we have seen the federal estate tax exemption rise from $600,000 per person in 1997 to its current level of $11.58 million per person. This means that, while people who died with estates valued over $600,000 were taxed in 1997, a person would now need to die with more than $11.58 million to have a taxable estate. Over that same period, the top estate tax rate is fallen from 55% to 40%.

According to the Tax Policy Center, of the estimated 2.8 million people who will die in America in 2020, just 4,100 will need to file an estate tax return, and only 1,900 will pay tax. That is a decrease from 109,600 returns filed in 2001, and 50,500 estates that paid tax that year. Because of the increased exemption, fewer estates are required to pay federal estate tax, and those estates are generally taxed at a lower rate today than 20 years ago.

Individual states also have their own estate taxes. The State of Minnesota taxes estates valued over $3,000,000, but does not tax gifts made during the person’s lifetime. The State of Wisconsin does not have an estate tax or gift tax.

Sunset of the Estate Tax Exemption

The current estate tax exemption of $11.58 million is the result of legislation called the Tax Cut and Jobs Act passed at the end of 2017. The act increased the estate tax exemption from $5.49 million in 2017 to $11.18 million in 2018. The exemption amount adjusts each year with inflation.

Because of congressional budget rules, the 2017 increase in the estate tax exemption is temporary. Unless new legislation is passed, the increased estate tax exemption will expire at the end of 2025. At that time, it is expected to fall to approximately $6 million.

What to Expect in 2021 and Beyond

The estate tax has become a political issue. Generally, Republicans favor increasing the federal estate tax exemption, reducing the tax rate, or eliminating the estate tax entirely. Democrats generally favor a lower federal estate tax exemption, raising the tax rate, and possibly eliminating something called the “step-up in basis.”

Prior to the election, there was speculation that both the Presidency and the Senate could flip from Republican to Democratic control in 2021. Together with Democratic control of the House of Representatives, this would have given Democrats the ability to pass legislation reducing the estate tax exemption prior to the end of 2025, instead of waiting for the sunset.

Biden made several policy proposals during his campaign that impact estate planning. Here are a few:

- Reduce the estate tax exemption to $3.5 million ($7 million for a married couple).

- Increase the estate tax rate from 40% to 45%.

- Raise the capital gains tax rate for people with more that $1 million in annual income. These capital gains and qualified dividends would be taxed at ordinary income tax rates of 39.6%.

- Eliminate the step-up in basis. The step-up in basis erases capital gains on most property passing at a person’s death. If the step-up were eliminated, tax would be imposed on unrealized capital gains regardless of whether the asset was sold following the person’s death.

While nothing is final until after the runoff election in Georgia on January 5th, it appears the country may end up with a divided government – Democrats controlling the Presidency and House of Representatives, and Republicans controlling the Senate. Most if not all of Biden’s proposed changes will be difficult to pass unless Democrats control the senate. Many of these proposals may need to wait until after the 2022 election, when another 34 Senate seats will be decided.

Even if Biden is unable to immediately achieve his proposed changes, the estate tax exemption sunset is still looming and the next election is only two years away. Clients with estates in excess of $3.5 million will need to pay attention over the next five years to changes that may impact how their estate will be taxed.

____________________________________

OFFICE DESIGN IN A POST COVID WORLD

The coronavirus pandemic has disrupted the workplace in ways that few business owners could have predicted. Previous office workspace design trends including open offices, team-based workspaces, co-working, and flexible workstations are being critiqued and, in some cases, dismissed. The number of building occupants are being reduced as employees become accustomed to working from home and building owners are de-densifying to create physical distancing. So, is the workplace as we know it a relic of the past? Is the commercial office space no longer relevant?

The likely reality is that we will return to the collective workplace, but one that has fundamentally changed from what we previously worked in. People crave the community, connectivity, and creativity of the office. A 2-year Stanford study showed a productivity boost among telecommuters but that more than half the group changed their minds about working from home daily because they felt too much isolation.

Office designers and business owners have scrambled to invite these people back to work safely with clear plastic sneeze guards and floors taped off at 6-foot increments. While these short-term fixes are part of our new normal, the focus of long-term workplace design will be a holistic approach to health and wellbeing. Architects and engineers will be creating new and revisiting some old ideas to make buildings safer and healthier to occupy, increase productivity, promote hybrid work schedules, and giving the user a confident and stimulating environment in which to work.

Don't Shoot the Breeze

One of the simplest ways to prevent the indoor spread of a contagious virus is to increase the volume of outside air that comes into our buildings. Simply opening a window can dilute the particles in the air. This is a big change because most contemporary American office buildings have inoperable windows to create an airtight seal for energy efficiency. When weather forces our windows closed it becomes important to install a highly efficient heating and cooling systems that filters and exchanges air at increased rates.

Open the Plan Up

Some designers have thought this might be the end of the open office trend. The simple truth is that an open office where you work in distanced space, surrounded by a lounge and individual work areas, designed to facilitate distancing and enhanced airflow is a much healthier environment. There is a lot of benefit to spending time near daylight and fresh air and an open office can make that happen.

Hands-Off

Designers will be trying to eliminate shared touch points wherever possible. Hands free door pulls, doorless bathroom entry systems, touchless plumbing fixtures are all building elements that architects are employing today. Antimicrobial flooring, countertops, and even paint are making significant impacts as a first line of defense against the spread of germs, bacteria, and other pathogens.

Work On Your Flexibility

While not a new concept in office design, flexible workspaces are more important than ever as employers compete to bring employees back to the office. Instead of private offices, employers will offer all types of working configurations including desks, high tops, phone rooms, booths, soft seating lounges, and lockers for personal belongings. This agile work environment allows easy portability for those working in a hybrid home and office schedule and replicates what many of us work like in our homes.

Conclusion

The workplace is not going away. The benefits of community, connectivity, and culture you get in a collaborative space cannot be replaced by working remotely. The challenge for designers and business owners is to provide a workplace that is productive and healthy. Ultimately, this reinvention of the office will lead to an environment where people can enjoy their workday and collaborate with colleagues while staying safe, healthy, and creative.