In this September 2019 issue, you will find the following articles:

- Alex R. Zeien, CTFA, AIFM®

- Nick WIlson

- Liz Pizzi

SAVING AND INVESTING WISELY

Saving builds a foundation

The first step in investing is to secure a strong financial foundation. Start with these four basic steps:

- Create a "rainy day" reserve: Set aside enough cash to get you through an unexpected period of illness or unemployment--three to six months' worth of living expenses is generally recommended. Because you may need to use these funds unexpectedly, you'll generally want to put the cash in a low-risk, liquid investment.

- Pay off your debts: It may make more sense to pay off high-interest-rate debt (for example, credit card debt) before making investments that may have a lower or more uncertain return.

- Get insured: There is no better way to put your extra cash to work for you than by having adequate insurance. It's your best protection against financial loss, so review your home, auto, health, disability, life, and other policies, and increase your coverage, if needed.

- Max out any tax-deferred retirement plans, such as 401(k)s and IRAs: Putting money in these accounts defers income taxes, which means you'll have more money to save. Take full advantage if they are available to you.

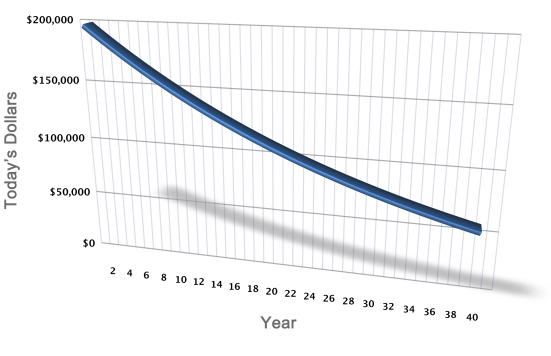

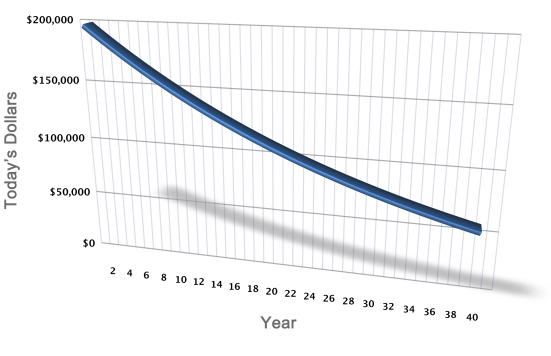

The impact of 3% yearly inflation on the purchasing power of $200,000

Why invest?

To try to fight inflation

When people say, "I'm not an investor," it's often because they worry about the potential for market losses. It's true that investing involves risk as well as reward, and investing is no guarantee that you'll beat inflation or even come out ahead. However, there's also another type of loss to be aware of: the loss of purchasing power over time. During periods of inflation, each dollar you've saved will buy less and less as time goes on.

To take advantage of compound interest

Anyone who has a savings account understands the basics of compounding: The funds in your savings account earn interest, and that interest is added to your account balance. The next time interest is calculated, it's based on the increased value of your account. In effect, you earn interest on your interest. Many people, however, don't fully appreciate the impact that compounded earnings can have, especially over a long period of time.

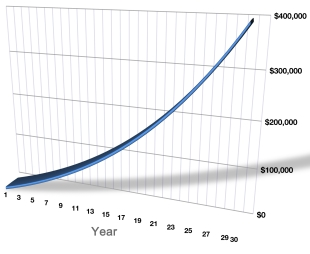

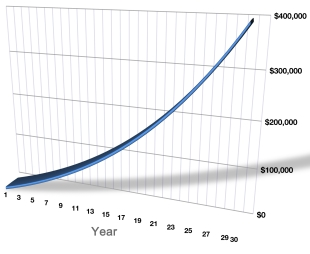

Compounding interest

Let's say you invest $5,000 a year for 30 years (see illustration). After 30 years you will have invested a total of $150,000. Yet, assuming your funds grow at exactly 6% each year, after 30 years you will have over $395,000, because of compounding.

Note: This is a hypothetical example and is not intended to reflect the actual performance of any specific investment. Taxes and investment fees and expenses are not reflected. If they were, the results would be lower. Actual results will vary. Rates of return will vary over time, particularly for long-term investments.

Compounding has a "snowball" effect. The more money that is added to the account, the greater its benefit. Also, the more frequently interest is compounded--for example, monthly instead of annually--the more quickly your savings build. The sooner you start saving or investing, the more time and potential your investments have for growth. In effect, compounding helps you provide for your financial future by doing some of the work for you.

_________________________________________________

IS IT STILL A GOOD TIME TO BUY INVESTMENT PROPERTY?

There are countless options available for you to invest your finances these days such as stocks, bonds, mutual funds, annuities, options and so on. Although these investments can be fruitful, they don’t always offer the immediate cash flow and protection of a brick and mortar investment. Diversification of investments is also a sure-fire way to lower your risk in the event of any unforeseen turn in events. Having real estate can be an advantageous option in your portfolio.

The Twin Cities Metro wide market has historically been proven to sustain economic uncertainties and continue a steady and healthy growth in rental markets including multi-family housing and commercial retail development. Rental rates are at an all time high with a strong demand for new housing and leasing.

In their simplest form, real estate investment properties are valued based on their income and expenses. There are other variables such as location, terms in current leases at the property, and overall condition to take under consideration. However, the investment property will be assessed at its income producibility first and foremost. These types of investments can be very valuable if purchased correctly with a good commercial real estate agent or if you have relative knowledge on how to understand the analysis of such properties.

The opportunity to own an income producing real estate investment that offers positive and healthy cash flow, desirable ROI, cap rate and tax savings is something you should not overlook as an investment. Low interest rates coupled with an incredible current rental market in the Twin Cities Metro and greater Western WI area make this an opportune time to find an investment property that is right for you.

If you are looking for a possible real estate investment and would like to discuss this topic further, I would be happy to assist. Please contact Nicholas Wilson or TJ Wilson at 651-230-0762 or visit our website at www.applegatecommercial.com for more contact information and possible listing we have available.

_________________________________________________

TRAINING SERVICES TO MEET YOUR NEEDS

The labor market is competitive. Unemployment is low. Positions continue to go unfilled every day. Businesses are scrambling to find solutions to assist in developing their culture and retaining their current workforce. I am Liz Pizzi, WITC Associate Dean of Workforce and Community Development. My role at WITC is to assist businesses and create creative solutions to attract and retain workers. In St. Croix County EDC Executive Director, Bill Rubin’s blog “Employers Face Workforce Challenges head-On” offered solutions to workforce challenges. The following is how WITC can assist with business services.

Attract and retain talent

A great solution to attract talent is to recruit Wisconsin Technical College graduates. Wisconsin TechConnect allows you to post employment opportunities at no cost. Find more information at

www.wisconsintechconnect.com.

Upskill existing workers and improve career pathways

WITC will work with your business to develop a customized training plan to increase your competitive edge and drive success in a changing world. Learning is flexible, convenient, and delivered on-site at your location, location of choice, or on our campus. WITC also has a variety of mobile labs to assist with hands-on delivery.

Nicki O’Connell, Director of Human Resources at Russ Davis said, “Russ Davis is thankful to have business partners like WITC. In a time of tight labor markets and limited resources, employers must be creative on how they recruit and facilitate growth for their employees. Russ Davis strives to create valuable career opportunities and by partnering with WITC, we have been able to give employees outstanding career paths, as well as meet continuing business growth demands.”

Training offered across the Northwest Wisconsin Region includes but is not limited to Workplace Safety, First-Aid/CPR, CDL Class A and B, Manufacturing, Healthcare, Leadership Management, and Essential Supervisory and Employee Skills.

Promote apprenticeships

WITC has a director of Apprenticeship and Workforce Training who is available to inform businesses about apprenticeship opportunities and creating new programs to meet regional workforce needs.

Promote career awareness

We welcome you onto our campus to provide information and opportunities to our students regarding local careers. It is a good time to encourage job shadows and to participate in our employer events.

Reach disconnected groups

Our networking alliances with economic development, workforce development boards, nonprofits, and other governmental agencies, such as OSHA and UW-Sout MOC, provide even more resources and opportunities to reach disconnected groups.

WITC has many solutions to align with workforce challenges. Are you worried about the financial obligation to find and implement solutions? Workforce Advancement Training (WAT) Grants are available. This is a competitive program administered by the Wisconsin Technical College System (WTCS). The grant awards allow your business to utilize technical college training to upgrade your employees’ skills and productivity. Contact me to see if a WAT Grant is a good fit for your business and for more information on employer services.